What Happened?

Powered by MasterCFA.com

Wedbush analysts have released a significant report suggesting that a potential Trump victory in the upcoming U.S. presidential election could negatively impact Big Tech companies. The analysis highlights concerns about escalating U.S.-China tech conflicts and potential tariff increases that could affect major players like Nvidia, Apple, and Tesla.

Why Does This Matter?

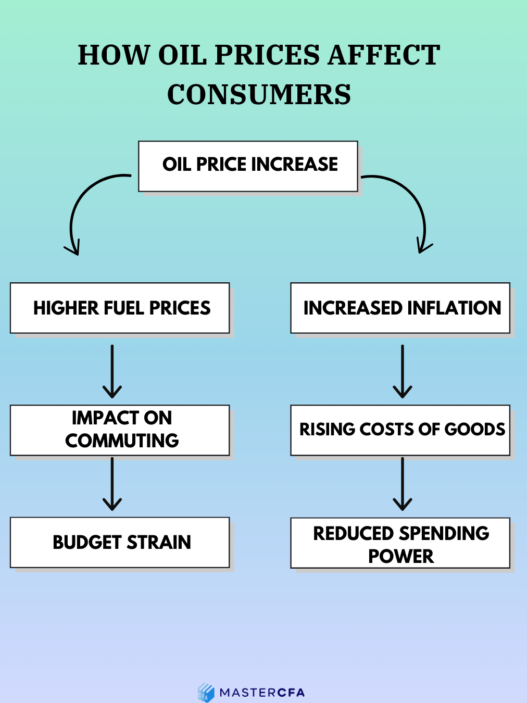

Economic Impact

- Potential disruption of global tech supply chains

- Increased tariffs affecting tech sector profitability

- Possible slowdown in AI development and implementation

- Market volatility in tech stocks affecting broader indices

Business and Consumer Effects

- Higher consumer prices for tech products due to tariffs

- Supply chain restructuring costs for businesses

- Impact on tech innovation and development timelines

- Employment shifts in tech manufacturing sectors

Theoretical Concepts in Action

Economic Theories at Play

- Trade Policy and Market Efficiency

- Tariffs and their impact on market equilibrium

- International trade theory and comparative advantage

- Policy uncertainty effects on market behavior

- Political Economy Framework

- Regulatory impact on market structure

- Government intervention in markets

- Competition policy and antitrust considerations

Real-World Applications

Historical Example: The 2018-2019 U.S.-China trade war led to:

- 25% tariffs on Chinese tech imports

- Apple’s consideration of moving 15-30% of production outside China

- 11% increase in consumer electronics prices

What Could Happen Next?

- Short-term Scenarios

- Market volatility around election results

- Tech companies accelerating supply chain diversification

- Potential regulatory changes under new administration

- Long-term Implications

- Restructuring of global tech supply chains

- Shift in AI development leadership

- Changes in competitive dynamics between U.S. and Chinese tech firms

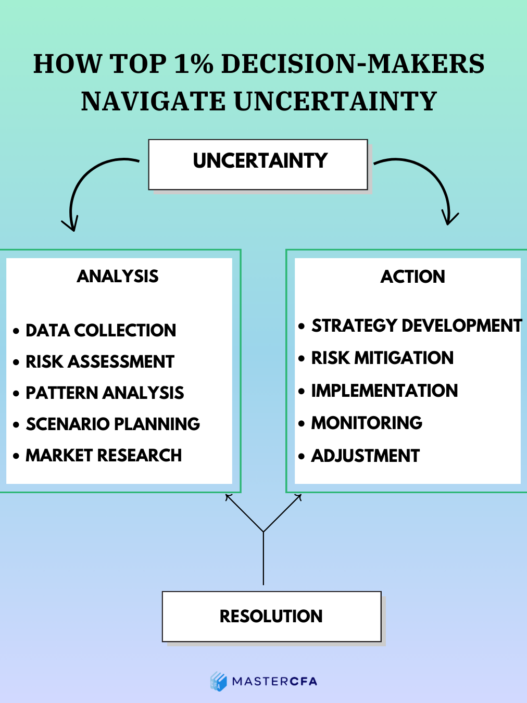

Why You Should Pay Attention

Understanding the intersection of politics and tech markets is crucial for:

- Identifying investment opportunities in shifting market conditions

- Anticipating industry trends and regulatory changes

- Making informed decisions about sector rotation in portfolios

- Developing risk management strategies for tech investments

Questions to Ponder

- How might increased tariffs affect the pace of AI innovation globally?

- What alternative supply chain strategies could tech companies employ to mitigate political risks?

- How would changes in FTC leadership affect Big Tech’s competitive landscape?

- Could political tensions create opportunities for emerging tech markets in other regions?

Keep Learning with MasterCFA: Understanding the interplay between political dynamics and tech markets is crucial for modern financial analysts. Dive deeper into these topics to enhance your understanding and prepare for the CFA Exam. Explore more insightful articles and resources with MasterCFA to stay ahead in your finance career.