What Happened?

Powered by MasterCFA.com

Following Canadian Prime Minister Justin Trudeau’s surprise resignation, US President-elect Donald Trump proposed merging Canada with the United States, suggesting it become the 51st state. Trump made this announcement on his social media platform, Truth Social, citing trade deficits and security concerns as key motivators. The proposal came just hours after Trudeau’s resignation announcement, which was prompted by growing unpopularity within his Liberal Party.

Why Does This Matter?

Economic Impact

- The proposal could fundamentally reshape North American trade dynamics

- Potential elimination of cross-border tariffs and trade barriers

- Integration of two major economies with combined GDP exceeding $25 trillion

- Unified currency implications and monetary policy considerations

Personal and Business Effects

- Potential tax structure changes for Canadian citizens and businesses

- Cross-border employment opportunities and labor market integration

- Impact on real estate markets and property values

- Changes in regulatory frameworks affecting business operations

Theoretical Concepts in Action

Economic Theories at Play

- Economic Integration Theory

- Complete economic union concept

- Factor mobility and market integration

- Currency union implications

- Trade Theory

- Comparative advantage optimization

- Trade creation vs. trade diversion effects

- Market efficiency and resource allocation

Real-World Applications

Historical examples of economic integration:

- European Union formation and its economic impact

- German reunification’s economic effects (1990)

- Texas annexation by the United States (1845)

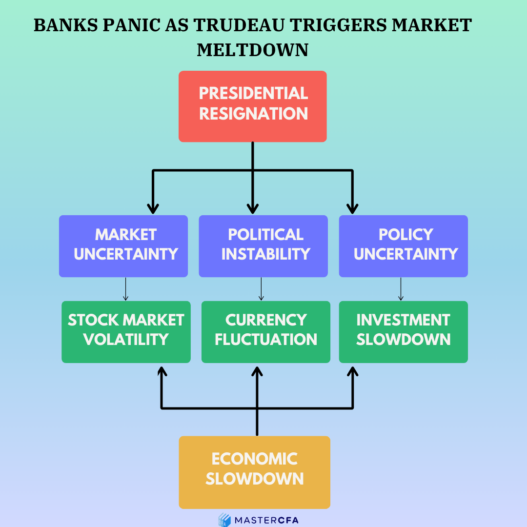

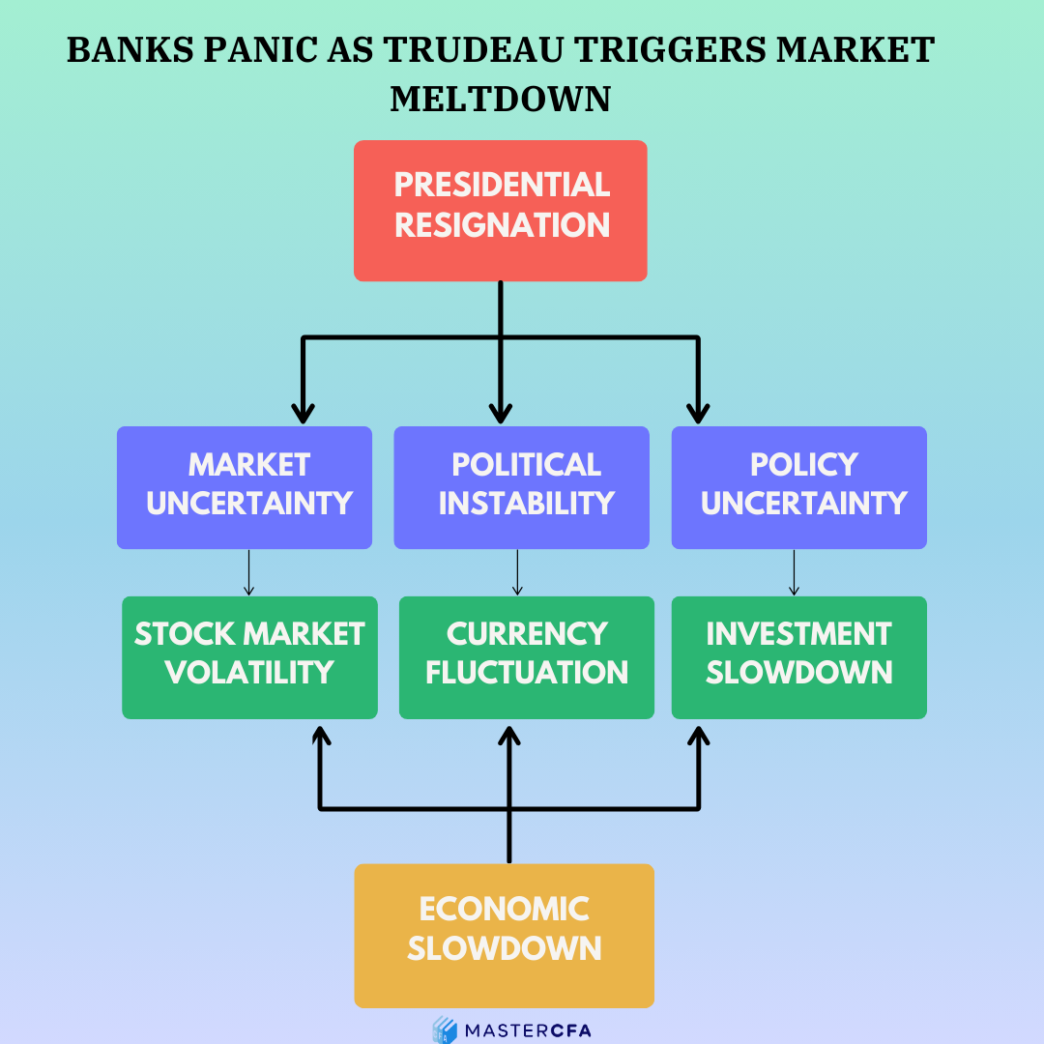

What Could Happen Next?

- Short-term Possibilities:

- Increased market volatility in both countries

- Currency fluctuations affecting CAD/USD exchange rates

- Political negotiations and public debates

- Long-term Scenarios:

- Potential constitutional reforms

- Integration of financial markets and institutions

- Harmonization of regulatory frameworks

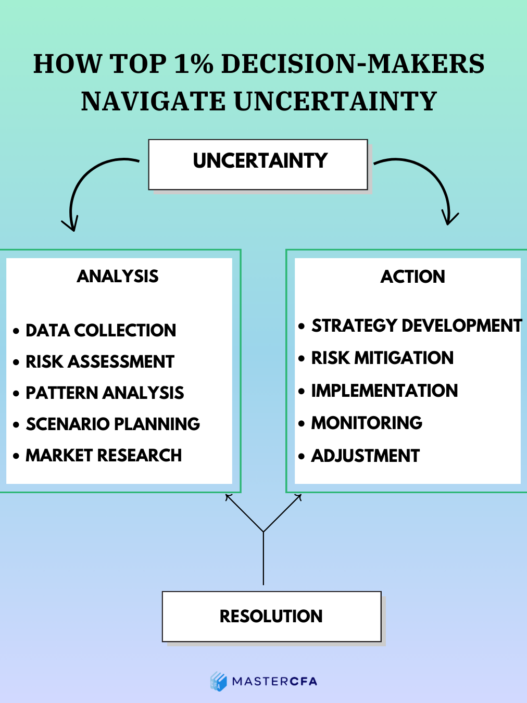

Why You Should Pay Attention

Understanding these developments is crucial for:

- Portfolio management strategies in North American markets

- Risk assessment in cross-border investments

- Identifying emerging investment opportunities

- Currency risk management in international portfolios

- Real estate investment decisions in both markets

Questions to Ponder

- How would a US-Canada merger affect global trade dynamics and existing international agreements?

- What implications would a unified currency have on monetary policy and inflation control?

- How might this affect the competitiveness of North American markets globally?

- What would be the impact on natural resource management and energy policies?

Keep Learning with MasterCFA:

Understanding economic integration and its impact on financial markets is crucial for any finance professional. This real-world scenario perfectly illustrates key concepts covered in the CFA Exam curriculum. Explore more insightful analyses and resources with MasterCFA to enhance your understanding of global financial markets and prepare for your career in finance.

Keywords: economic integration, trade policy, market efficiency, currency markets, North American economy, financial markets, investment analysis