The Tide Turns: China’s Economic Resurgence

Powered by MasterCFA.com

What Happened?

A recent Bank of America (BofA) survey reveals a significant shift in sentiment among Asian fund managers. Following China’s announcement of various stimulus measures, investors have become increasingly bullish on Chinese markets and the broader Asian region. The survey, conducted in early October, gathered responses from 128 participants managing a total of $273 billion in assets.

Why Does This Matter?

Impact on the Economy:

This surge in optimism could potentially kickstart a new cycle of economic growth in China and, by extension, the entire Asian region. As China is the world’s second-largest economy, its economic health has far-reaching implications for global markets and trade.

Personal and Business Effects:

For individuals and businesses, this shift could mean:

- Increased job opportunities as companies expand operations in China

- Potentially higher returns on investments in Asian markets

- More robust supply chains as Chinese production ramps up

- Possible increase in consumer goods prices as demand in China rises

Economic Theories in the Real World

Theoretical Concepts in Action:

1. Fiscal and Monetary Policy Effectiveness

China’s use of both fiscal and monetary stimulus measures demonstrates the practical application of expansionary economic policies. These actions align with Keynesian economic theory, which advocates for government intervention to stimulate economic growth during downturns.

2. Investor Sentiment and Market Efficiency

The rapid shift in investor sentiment following China’s policy announcements reflects the Efficient Market Hypothesis (EMH). This theory suggests that markets quickly incorporate new information, leading to price adjustments – in this case, increased allocation to Chinese markets.

3. International Capital Flows

The reallocation of funds from Indian to Chinese markets illustrates the concept of international capital mobility. This shift demonstrates how global investors rapidly move capital in response to changing economic conditions and opportunities.

Real-World Application:

Historically, we’ve seen similar patterns of investor behavior and policy impact. For instance, during the 2008 financial crisis, China’s massive stimulus package not only boosted its economy but also had a ripple effect across global markets. Similarly, Japan’s economic policies in the 1980s led to a significant bull market, attracting international investors – a situation that parallels the current optimism about Japan in the BofA survey.

Crystal Ball Gazing: What’s Next?

What Could Happen Next?

- Sustained Growth in Chinese Markets: If the stimulus measures prove effective, we could see a prolonged period of growth in Chinese stocks and increased foreign investment.

- Sector Rotation: As investors favor technology and consumer discretionary sectors, we might witness a shift in market leadership.

- Regional Competition: Increased focus on China could lead to policy responses from other Asian countries to attract investment, potentially triggering a “race to the top” in terms of economic reforms.

- Global Economic Ripple Effects: A resurgent Chinese economy could boost global trade, potentially leading to inflationary pressures and influencing central bank policies worldwide.

The Smart Money: Why You Should Pay Attention

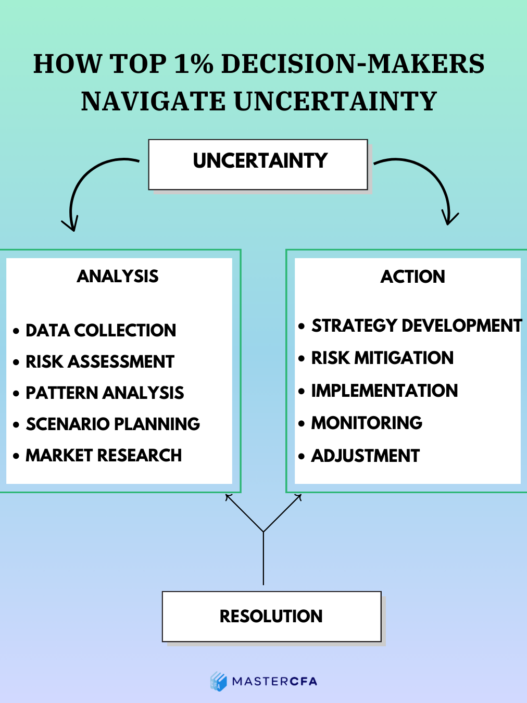

Understanding these market dynamics is crucial for several reasons:

- Investment Opportunities: Recognizing shifts in investor sentiment early can help you identify potential investment opportunities before they become mainstream.

- Risk Management: Being aware of changing economic landscapes allows you to better diversify your portfolio and manage risk.

- Career Development: For aspiring financial analysts, understanding how economic policies influence markets is essential for providing valuable insights to clients or employers.

- Personal Financial Planning: These trends can impact everything from job prospects to the value of your investments, making it crucial for informed personal financial decisions.

Food for Thought: Questions to Ponder

- How might the increased focus on China affect other emerging markets in the short and long term?

- What potential risks could arise if the optimism about China’s economy proves to be overblown?

- How might the shift towards technology and consumer discretionary sectors in China influence global industry trends?

- What strategies could other Asian countries employ to remain competitive in attracting international investment?

- How might the apparent difficulty for the Bank of Japan to raise interest rates affect global currency markets and carry trades?

Keep Learning with MasterCFA: Staying informed about global market trends and their economic impacts is essential for any budding analyst. Dive deeper into these topics to enhance your understanding and prepare for the CFA Exam. Explore more insightful articles and resources with MasterCFA to stay ahead in your finance career.