What Happened?

Powered by MasterCFA.com

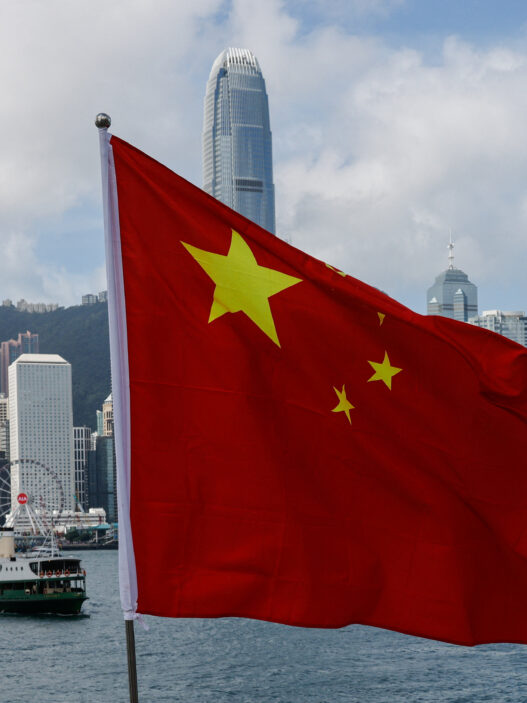

The US dollar showed weakness heading into the US Election Day, primarily due to shifting market sentiment around the presidential race. Recent polls indicating improved odds for Democrat Kamala Harris led to an unwinding of previous “Trump trades.” The dollar experienced a notable decline, falling 0.76% against the euro to reach a three-week low, while the dollar index edged down to 103.89.

Why This Matters

Economic Impact

- The currency markets are showing heightened sensitivity to political outcomes, with potential 1-2% movements expected based on election results

- Global trade relationships and monetary policy directions hang in the balance

- Market volatility could increase significantly if election results are disputed

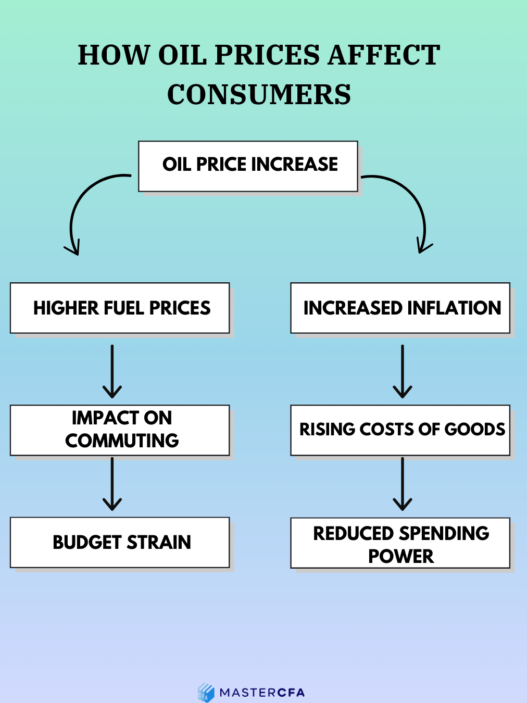

Business and Personal Effects

- Import/export businesses face uncertain pricing strategies

- International investors need to reassess portfolio hedging strategies

- Consumer purchasing power for imported goods could shift

- Travel costs and international business operations may need adjustment

Theoretical Concepts in Action

Key Economic Theories

- Political Economy Theory

- Political decisions directly influence monetary policy and currency valuations

- Election outcomes can trigger significant market repositioning

- Exchange Rate Determination

- Interest rate expectations

- Political risk premium

- Market sentiment and speculation

- Efficient Market Hypothesis

- Markets rapidly incorporate new information from polls

- Price adjustments reflect changing probability assessments

Real-World Applications

- Brexit Vote (2016): Similar market reactions occurred when unexpected political outcomes triggered major currency movements

- Japanese Yen during Abenomics (2012): Demonstrates how political policies can drive sustained currency trends

- Mexican Peso during 2016 US Election: Shows how currencies can act as proxies for political risk

What Could Happen Next?

- Short-term Scenarios

- Harris Victory: Potential 1-2% dollar weakness

- Trump Victory: Possible significant dollar strengthening

- Contested Results: Extended period of heightened volatility

- Medium-term Outlook

- Policy Implementation Phase

- Trade Relationship Adjustments

- Federal Reserve Response

Why You Should Pay Attention

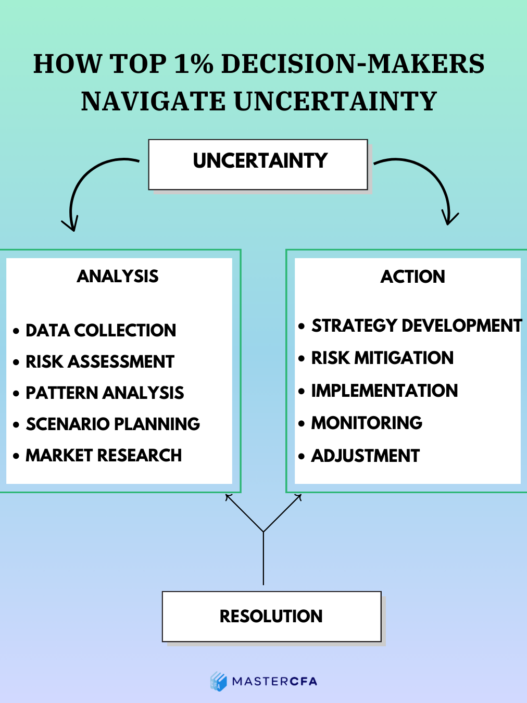

Understanding political impact on currency markets is crucial for:

- Portfolio risk management

- International investment decisions

- Business strategy planning

- Career development in global finance

- Identifying profit opportunities in currency trading

Questions to Ponder

- How might different election outcomes affect various sectors of the economy differently?

- What role does market psychology play in currency movements during political events?

- How can investors best position their portfolios to handle political uncertainty?

- What lessons from previous political events can be applied to current market conditions?

Keep Learning with MasterCFA: Understanding currency market dynamics and political risk factors is crucial for modern financial analysts. These concepts frequently appear in the CFA Exam and form the foundation of international investment analysis. Explore more insightful articles and resources with MasterCFA to master the interplay between politics and markets in your finance career.