What Unemployment Claims Reveal About the Economy

Last week, 225,000 people applied for unemployment benefits for the first time. This number was up from 219,000 the week before.

How Unemployment in a Country affects economy?

- Indicator of economic health: Low unemployment claims suggest businesses are doing well and people are working, while high claims signal layoffs and economic trouble.

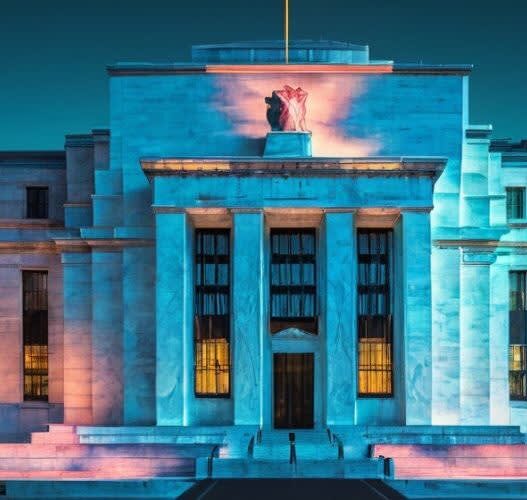

- Influences Federal Reserve decisions: The Fed uses job numbers to decide whether to lower or raise interest rates to control economic growth.

- Impact on consumer spending: If more people lose jobs, they have less money to spend, which can slow down the economy.

- Hiring trends: A decrease in people continuing to claim benefits hints that companies are hiring again, which is good for the economy.

- Market reactions: Investors use these numbers to predict how the economy will move and adjust their strategies accordingly.

What Could Happen Next?

This week’s job numbers are crucial. The Federal Reserve (the Fed) will be paying close attention to several factors, such as:

- Job Growth: The number of new jobs created can indicate whether businesses are hiring or letting go of workers. If job growth is strong, it may signal a robust economy. If it’s weak, it could mean economic trouble ahead.

- Sector Health: The performance of various sectors like services and manufacturing gives a clearer picture of economic activity. A decline in these sectors can show that businesses are struggling, which may lead to more layoffs.

- Overall Economic Growth: The Fed will look at economic indicators like GDP growth. A slowing economy can prompt the Fed to take action to stimulate growth.

Depending on what the job numbers reveal, the Fed might consider lowering interest rates again. Lowering rates makes borrowing cheaper, encouraging consumers to spend more and businesses to invest in growth.

In summary, when people are employed and spending money, the economy tends to grow. This growth creates a positive cycle where businesses thrive, jobs are created, and overall economic conditions improve. On the other hand, if unemployment rises and spending decreases, the economy slows down. This is when the Fed often steps in, using tools like interest rate cuts to encourage borrowing and spending, aiming to revive economic activity.