What Happened? The Political-Monetary Dance

Powered by MasterCFA.com

The Bank of Japan (BOJ) is expected to maintain its current interest rate at 0.25% during its upcoming Thursday meeting. This decision comes amid significant political changes, as Japan’s ruling Liberal Democratic Party (LDP) recently lost its parliamentary majority. The political shift has created uncertainty around the BOJ’s ability to continue its monetary tightening plans.

Why Does This Matter?

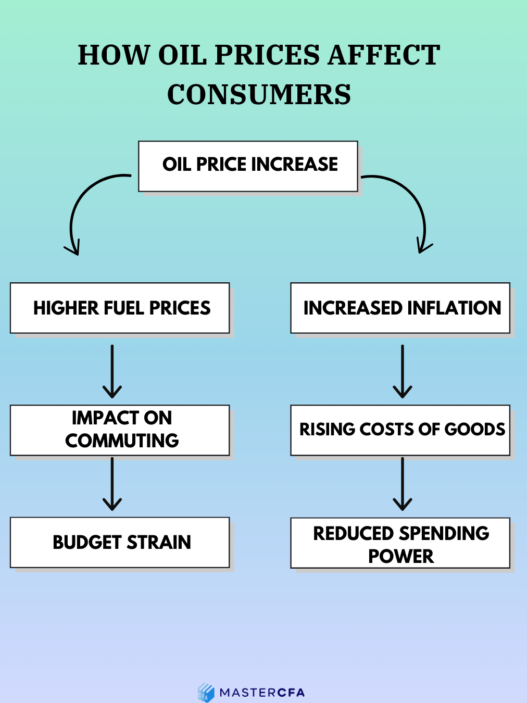

Impact on the Economy

- The political uncertainty could lead to increased fiscal spending

- Monetary policy tightening might face stronger opposition

- Consumer inflation struggles to maintain the BOJ’s 2% target

- Recent slowdown in wage growth and private consumption

Personal and Business Effects

- Families benefit from continued low borrowing costs

- Businesses can maintain cheaper financing options

- Potential for increased government spending on social programs

- Impact on savings returns remains minimal

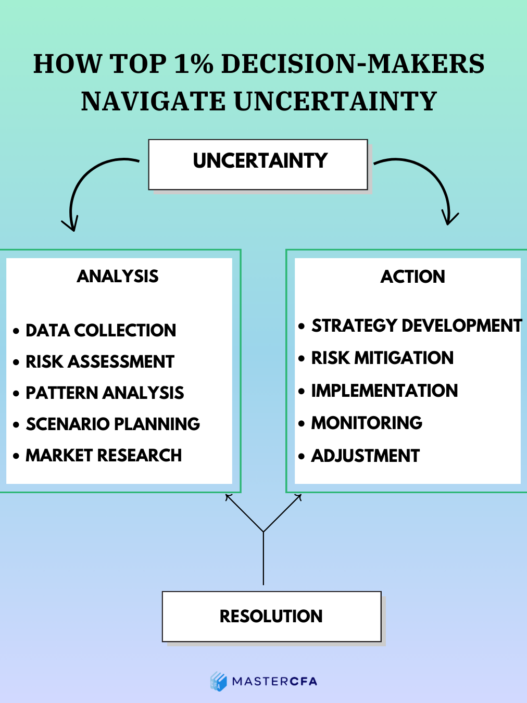

Theoretical Concepts in Action

Economic Theories at Play

- Monetary Policy Independence

- Central bank autonomy vs. political influence

- Interest rate transmission mechanism

- Price stability objectives

- Phillips Curve Relationship

- Wage growth and inflation dynamics

- Employment and price level correlations

- Currency Exchange Dynamics

- Interest rate differentials

- Political risk premium in forex markets

Real-World Application

Historical Example: Japan’s Lost Decades (1991-2010)

- Demonstrated the challenges of breaking deflationary cycles

- Showed the limitations of monetary policy in isolation

- Highlighted the importance of coordinated fiscal and monetary actions

What Could Happen Next?

- Short-term Scenarios

- BOJ might delay further rate hikes

- Increased fiscal stimulus packages

- Continued yen weakness against major currencies

- Medium-term Outlook

- Potential policy normalization in 2025

- Gradual adjustment to interest rates

- Evolution of wage-price dynamics

Why You Should Pay Attention

Understanding these developments is crucial for:

- Portfolio management in global markets

- Currency exposure decisions

- Investment opportunities in Japanese markets

- Risk assessment in international investments

Questions to Ponder

- How might the relationship between central bank independence and political influence evolve in developed economies?

- What are the long-term implications of maintaining ultra-low interest rates for economic growth and financial stability?

- How do political changes influence investment opportunities in currency and equity markets?

- Can monetary policy effectively achieve its objectives without supportive fiscal policy?

Keep Learning with MasterCFA: Understanding monetary policy decisions and their market implications is crucial for financial analysts. These real-world scenarios provide valuable insights into the complex interplay between politics, economics, and markets. Enhance your knowledge of these critical concepts as you prepare for the CFA Exam. Explore more insightful articles and resources with MasterCFA to stay ahead in your finance career.