What Happened?

Powered by MasterCFA.com

Top executives from major U.S. energy pipeline companies announced that new crude oil pipelines from the Permian shale field in West Texas are unlikely to be built. This decision stems from slow volume growth and challenges in constructing new lines. Instead, companies are focusing on optimizing existing pipelines. For instance, Enterprise Products Partners and Plains All American Pipeline are prioritizing enhancements over new constructions.

Why Does This Matter?

Impact on the Economy

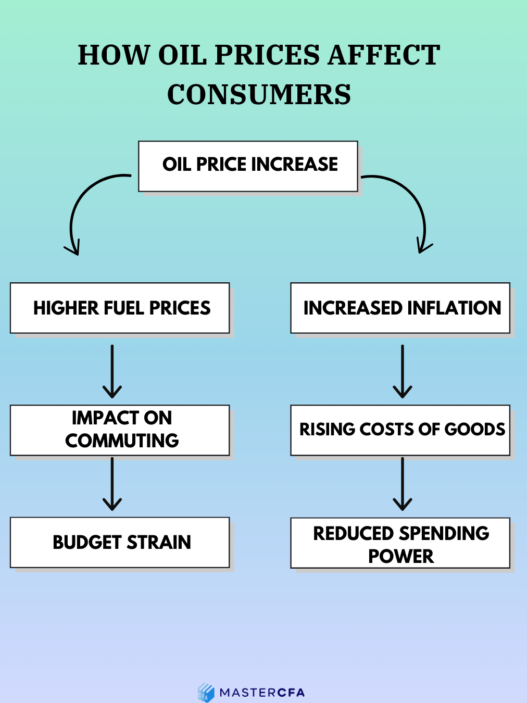

The decision to halt new pipeline constructions could have significant implications for both local and global economies. With limited new infrastructure, the ability to transport oil efficiently may be hindered, potentially affecting oil prices and supply chains. This could lead to increased volatility in energy markets, impacting everything from fuel prices to inflation rates.

Personal and Business Effects

Families and businesses could feel the effects of these decisions in various ways. Higher oil prices may lead to increased costs for transportation and goods, affecting household budgets and business operations. Companies reliant on oil for production may face tighter margins, leading to potential layoffs or reduced investment in growth.

Theoretical Concepts in Action

Economic Theories

This situation illustrates several economic theories, including supply and demand dynamics and market equilibrium. The reluctance to build new pipelines reflects a cautious approach to managing supply in response to fluctuating demand, which is a fundamental principle in microeconomics.

Real-World Application

Historically, the construction of new pipelines has often followed periods of rapid production growth. For example, during the shale boom of the last decade, many new pipelines were built to accommodate rising output. However, the current restraint in building new infrastructure suggests a shift towards a more sustainable approach, where companies prioritize stability over rapid expansion.

What Could Happen Next?

Looking ahead, the focus on optimizing existing pipelines may lead to increased efficiency in oil transport. However, if production levels rise unexpectedly, the lack of new infrastructure could create bottlenecks, leading to price spikes. Additionally, ongoing regulatory challenges and market dynamics will play a crucial role in shaping the future of oil transportation.

Why You Should Pay Attention

Understanding the implications of these developments is crucial for making informed personal finance and investment decisions. By grasping the relationship between oil supply, infrastructure, and market dynamics, individuals can better navigate the complexities of energy investments and their broader economic impacts.

Questions to Ponder

- How might the lack of new pipeline construction affect oil prices in the short and long term?

- What strategies can businesses adopt to mitigate the impact of rising oil costs?

- How do supply chain disruptions in the oil industry affect other sectors of the economy?

- In what ways can understanding these dynamics improve personal investment strategies?

- What role do government regulations play in shaping the future of oil infrastructure?

Keep Learning with MasterCFA: Staying informed about oil price dynamics and their economic impacts is essential for any budding analyst. Dive deeper into these topics to enhance your understanding and prepare for the CFA Exam. Explore more insightful articles and resources with MasterCFA to stay ahead in your finance career.