The Latest Oil Market Shake-up: What’s Moving Prices?

Powered by MasterCFA.com

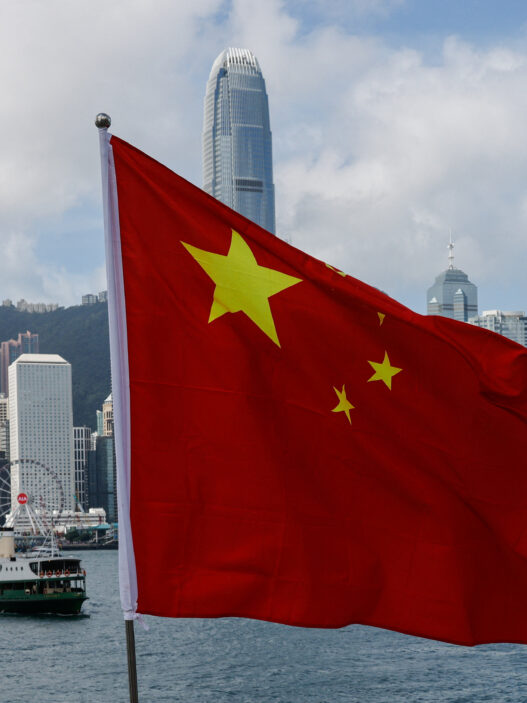

Oil prices are heading for significant weekly gains despite a slight dip in Asian trading. The key drivers? OPEC+ postponing production increases, potential U.S. supply disruptions from Hurricane Rafael, and ongoing Middle East tensions. Brent crude and WTI are up 3-4% this week, with markets eagerly awaiting China’s stimulus announcements.

Why These Oil Market Moves Matter

Global Economic Impact

- OPEC+’s decision to maintain production cuts of 6 million barrels per day directly affects global oil supply

- China’s expected $1.6 trillion stimulus package could boost oil demand from the world’s largest importer

- Middle East conflicts continue to add risk premiums to oil prices

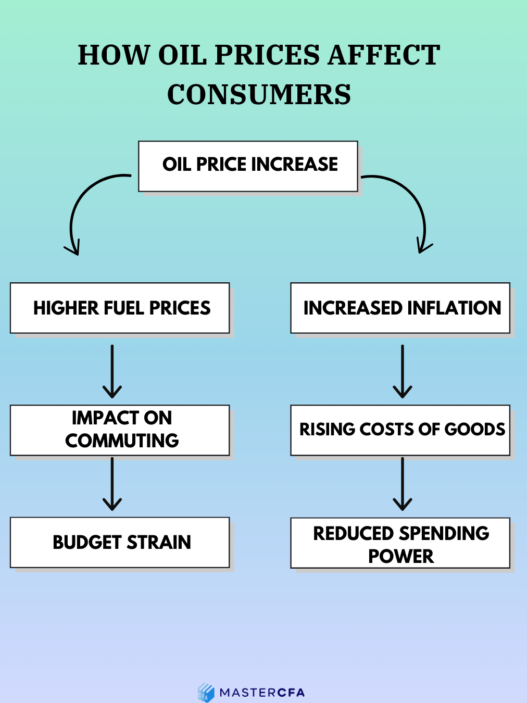

Personal and Business Effects

- Fuel prices impact transportation costs across industries

- Energy-intensive businesses face uncertain operational costs

- Household budgets affected through direct fuel costs and indirect price increases

Economic Theories at Play

Supply and Demand Dynamics

- Supply-Side Management: OPEC+’s production cuts demonstrate cartel behavior in controlling market prices

- Demand Elasticity: China’s stimulus showcases how government policy can influence commodity demand

- Price Floor Theory: OPEC+’s actions effectively create a price floor in the oil market

Real-World Applications

Historical Example: The 2014-2016 oil price war, when Saudi Arabia increased production to maintain market share, led to prices dropping below $30/barrel. Today’s coordinated production cuts show how cartels learn from past experiences to maintain price stability.

Future Scenarios and Implications

- Bullish Scenario:

- Successful Chinese stimulus implementation

- Continued OPEC+ compliance

- Escalating Middle East tensions

- Bearish Scenario:

- Weak Chinese demand despite stimulus

- OPEC+ compliance issues

- Global recession fears

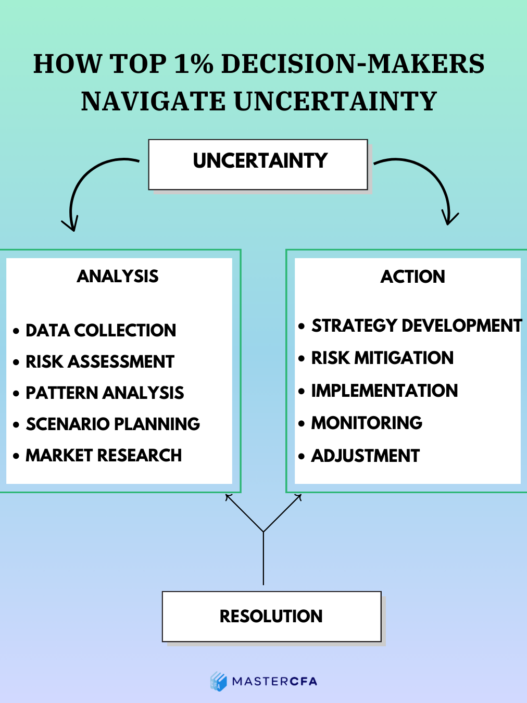

Investment Strategy Implications

Understanding oil market dynamics helps:

- Identify investment opportunities in energy sector

- Predict inflation trends

- Manage portfolio risk exposure

- Time commodity-related investments

Questions to Consider

- How might China’s stimulus package affect global oil demand patterns?

- What are the long-term implications of OPEC+’s production management strategy?

- How do geopolitical tensions in the Middle East influence investment decisions in the energy sector?

- What role does weather-related disruption play in short-term oil price volatility?

Keep Learning with MasterCFA: Understanding oil market dynamics and their economic impacts is crucial for financial analysts. These market movements demonstrate key economic principles covered in the CFA curriculum. Stay ahead in your finance career by exploring more detailed analysis and resources with MasterCFA.