What Happened?

Powered by MasterCFA.com

Crude oil futures have recently surged past $71.10, indicating potential gains towards the 200-day moving average. Despite this uptick, Brent crude is down 3.4% for the year, marking a second consecutive annual loss. OPEC+ has extended output cuts, but rising non-OPEC supply, particularly from Nigeria, raises concerns about oversupply in 2025. Market participants are closely watching U.S. Federal Reserve rate cuts and policy shifts for insights into future oil demand.

Why Does This Matter?

Impact on the Economy

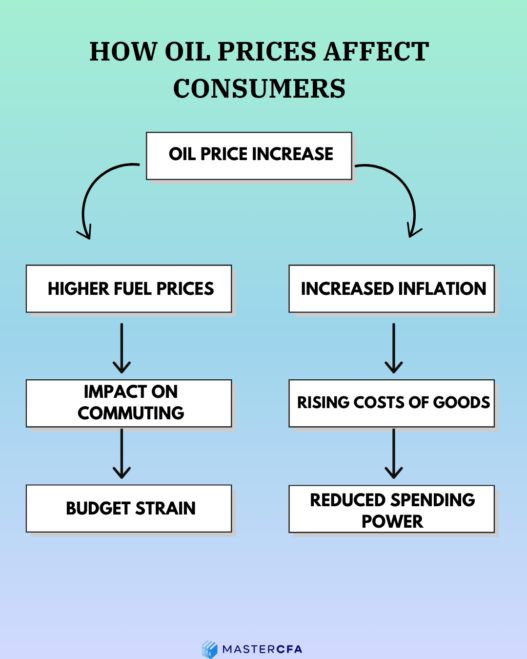

The fluctuations in oil prices significantly impact the global economy. Lower oil prices can lead to reduced inflation, affecting consumer spending and economic growth. Conversely, rising prices can strain budgets and slow down economic recovery, particularly in oil-dependent countries.

Personal and Business Effects

Families may face higher costs for fuel and goods, impacting their disposable income. Businesses, especially those reliant on transportation and energy, may experience increased operational costs, which could lead to higher prices for consumers.

Theoretical Concepts in Action

Economic/Quantitative/Finance Theories

This situation illustrates the Supply and Demand theory, where an increase in supply (from non-OPEC countries) and a decrease in demand (due to economic slowdowns) can lead to lower prices. Additionally, Market Equilibrium concepts are relevant as the market seeks a balance between supply and demand.

Real-World Application

Historically, the 2014 oil price crash exemplified how oversupply can lead to significant price drops, affecting economies worldwide. In a hypothetical scenario, if Nigeria successfully increases its production, it could exacerbate the current oversupply situation, leading to further price declines.

What Could Happen Next?

If the oversupply continues, oil prices may remain under pressure, potentially stabilizing between $68 and $72 per barrel. However, if demand unexpectedly increases due to economic recovery or geopolitical tensions, prices could rebound.

Why You Should Pay Attention

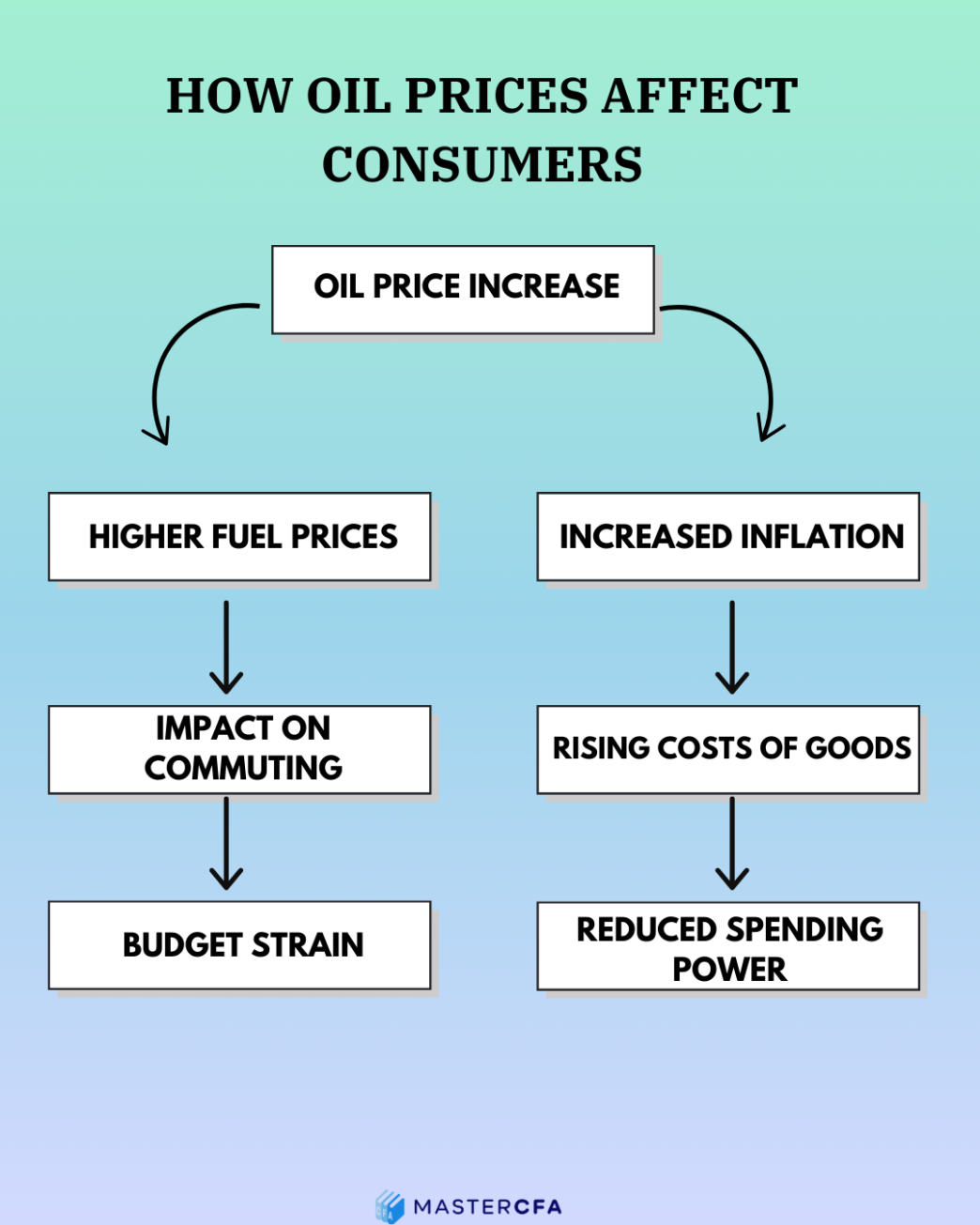

Understanding the dynamics of oil prices is crucial for making informed personal finance and investment decisions. Knowledge of supply and demand can help individuals anticipate market movements, allowing for better investment strategies and financial planning.

Questions to Ponder

- How do changes in oil prices affect inflation rates?

- What role do geopolitical events play in oil supply and demand?

- How can businesses adapt to fluctuating oil prices?

- What are the long-term implications of sustained low oil prices on the global economy?

- How might consumer behavior change in response to rising oil prices?

Keep Learning with MasterCFA:

Staying informed about oil price dynamics and their economic impacts is essential for any budding analyst. Dive deeper into these topics to enhance your understanding and prepare for the CFA Exam. Explore more insightful articles and resources with MasterCFA to stay ahead in your finance career.