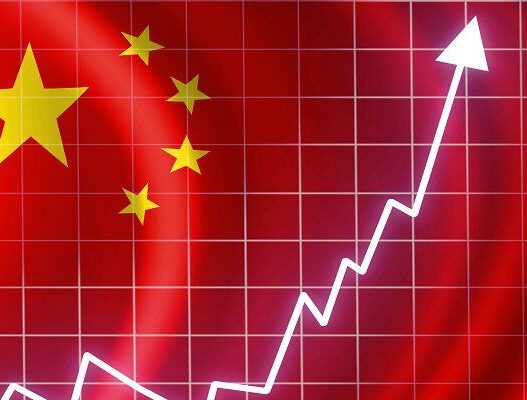

Recently, China’s leaders made some big money decisions to help the economy. They introduced new plans that helped the China index (FTSE A50) jump by 28% in just two weeks. This makes people wonder if it’s still a good time to invest or if they missed the chance.

Why Is This Important?

- Investor Feelings: Even with the jump, some experts at HSBC think it’s still a smart time to invest in China. They gave it a thumbs-up, meaning they believe it will do well.

- Looking Back: In the past, when the FTSE China index rose by more than 10%, it usually gained an average of 38% over 76 trading days. Sometimes, it even went up by 60%

- Price Check: Right now, Chinese stocks are cheaper compared to other countries. They are 18% less expensive than similar markets. Experts believe they are still 15% undervalued, which means they could rise more.

How Do These Factors Affect the Market?

- Less Investment: Investors currently have less money in China than usual, which might mean they’ll put more money in soon.

- Favourite Sectors: Experts like HSBC think areas like consumer goods and technology will grow a lot. These are good places for investors to consider putting their money.

- Need for Continued Help: While the recent money moves are good, China needs to keep supporting its economy. Since 2021, there hasn’t been enough help, but the signs now suggest they might change that.

Look before you leap:

- Possible Market Pullback: The recent surge in the market might not last forever. When a market rises quickly, it can sometimes lead to a drop in prices as people take profits or become cautious. This pullback could happen before the market finds its balance again. Investors should be prepared for some ups and downs in the coming weeks.

- Interest Rates and Inflation: Interest rates in other countries, especially the U.S., can affect how much money flows into China. If the U.S. raises interest rates, it could make borrowing more expensive, leading to less investment in emerging markets like China. Conversely, if rates stay low, it could encourage more investment in Chinese stocks.

- Political Events: The upcoming U.S. elections may cause uncertainty in the markets. Concerns about potential tariffs on Chinese imports could make investors nervous. If the outcome of the elections leads to new trade policies, it could impact how much money flows into China’s economy and its markets.

- Investor Sentiment: The feelings and attitudes of investors play a big role in the market. If investors feel positive about China’s prospects, they may be more willing to invest. On the other hand, if they feel unsure or worried, it could lead to a decline in investments.

How this can bring impact in day to day life

- Encouraging Spending: Government investments and low interest rates help people spend more on homes, cars, and businesses, driving economic growth.

- Boosting Investment: Confident investors are more likely to put money into the economy, leading to job creation and innovation, which benefits everyone.

- Overall Economic Health: A strong economy means more jobs and better living standards, creating a positive cycle for society.

- Diversification: Spreading investments across different areas reduces risk. If one investment struggles, others may do well.

- Exploring Opportunities: With China showing growth potential, individuals can find new chances to earn money by investing in diverse markets.

- Smart Decision-Making: Understanding economic changes helps people make informed investment choices, potentially improving their financial situations.