The Sudden Oil Price Plunge: What’s Behind It?

Powered by MasterCFA.com

Oil prices experienced a dramatic drop of over 4% after Israel’s strategic strike on Iran proved less disruptive than anticipated. Brent crude fell to $72.92 per barrel, while WTI dropped to $68.63 – both hitting their lowest levels since October 1st. This price movement came as markets processed Israel’s calculated response to Iran’s earlier missile attack, which notably avoided targeting oil infrastructure.

Why This Price Movement Matters

Global Economic Impact

- Immediate relief in global energy markets

- Reduced pressure on inflation concerns

- Potential stabilization of transportation and manufacturing costs

- Lower input costs for oil-dependent industries

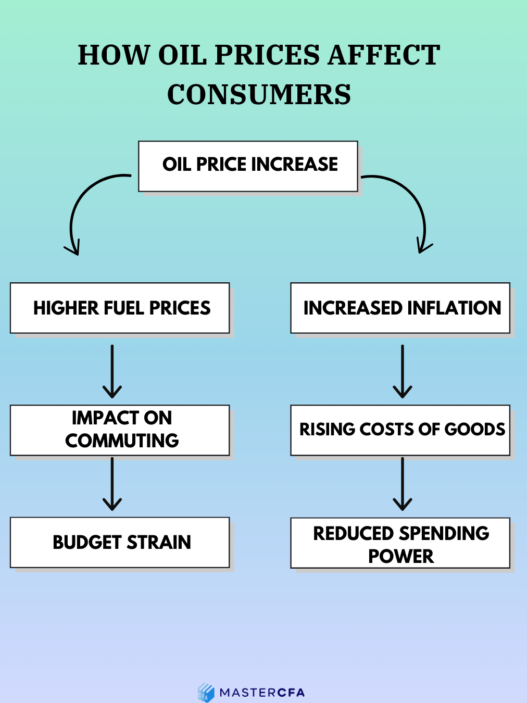

Personal and Business Effects

- Possible decrease in fuel prices for consumers

- Lower operational costs for businesses

- Reduced pressure on household budgets

- Potential improvement in profit margins for energy-intensive industries

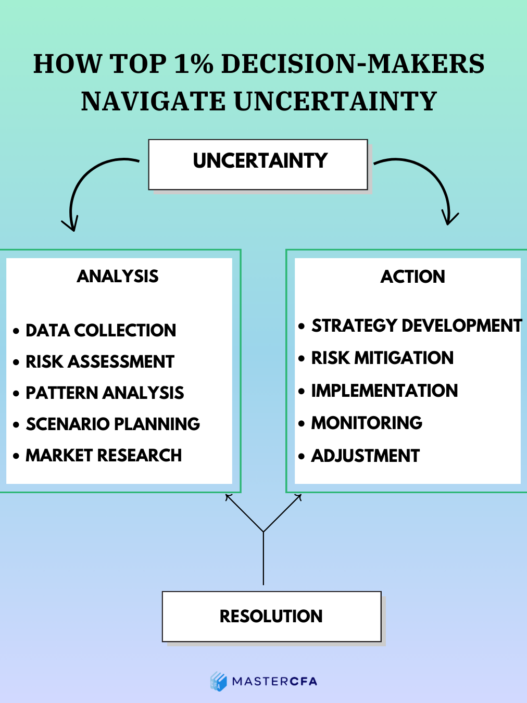

Market Theory in Action

Key Economic Concepts

- Risk Premium Theory

- Markets had priced in potential disruption

- Premium disappeared when risk diminished

- Supply and Demand Dynamics

- Market expectations of continued supply

- OPEC+ production decisions influence

- Geopolitical Risk Assessment

- Impact of political events on commodity prices

- Market efficiency in pricing information

Real-World Application

The current situation mirrors the 2019 Saudi Aramco drone attacks, where initial price spikes were followed by rapid normalization once supply disruption fears subsided. This pattern demonstrates how markets efficiently price in and out risk premiums based on evolving situations.

Looking Ahead: Potential Scenarios

- Base Case Scenario

- Continued de-escalation

- Gradual price stabilization

- Return to fundamental-driven pricing

- Risk Scenarios

- Renewed tensions leading to price volatility

- OPEC+ policy adjustments

- Changes in global demand patterns

Investment Implications

Understanding oil price dynamics helps investors:

- Identify entry and exit points in energy investments

- Assess portfolio risk exposure

- Make informed decisions about energy-dependent sectors

- Evaluate currency movements in oil-exporting countries

Questions to Consider

- How might OPEC+’s December meeting influence oil prices given current market conditions?

- What role does psychological pricing play in commodity markets during geopolitical events?

- How can investors differentiate between temporary price movements and fundamental shifts in oil markets?

- What implications does this have for renewable energy investments?

Keep Learning with MasterCFA: Understanding oil market dynamics and geopolitical risk assessment is crucial for modern financial analysts. These events provide real-world examples of market efficiency and risk premium concepts covered in the CFA curriculum. Explore more market insights and prepare for your CFA Exam with MasterCFA’s comprehensive resources.